The XLU ETF presents a compelling opportunity for investors seeking exposure to the utilities sector. This sector, characterized by its stability, offers steady dividends and a hedge against market volatility. However, navigating this landscape requires prudent analysis. Investors should consider factors such as political influences, monetary policy trends, and the adoption of new technologies. A comprehensive understanding of these dynamics is fundamental for making informed decisions.

It's important to allocate strategically within the utilities sector by analyzing various sub-sectors, such as electric utilities, gas utilities, and water utilities. Each sub-sector presents distinct risks and opportunities. Additionally, investors should explore factors such as earnings growth to select companies that align with their investment objectives.

Ultimately, the XLU ETF offers a attractive way to invest in the utilities sector. By conducting thorough research and utilizing a diligent investment approach, investors can navigate the potential this sector has to provide.

Examining XLU's Performance: A Comprehensive Analysis into Utility Stocks

The utility sector, tracked by the XLU ETF, has recently experienced substantial shifts. Traders are closely tracking the market's trajectory in light of macroeconomic uncertainty. To delve deeper, we will analyze XLU's current standing and pinpoint key influences shaping the outlook for utility stocks.

- Several factors affect the value of XLU and its underlying holdings. Factors such as

- Economic conditions

- Consumer spending

- Technological advancements

Is XLU the Right Investment for Your Portfolio?

When evaluating your portfolio, it's important to spread risk thoughtfully. One choice worth considering is the industry group represented by XLU, the iShares U.S. Financials ETF .

This fund offers investors a way to gain exposure the performance of major players across various subsectors within the industry .

- However, it's vital to understand the risks any investment before making a decision.

- Factors like your investment goals should guide your approach .

- Ultimately, assessing if XLU is the right fit for your portfolio requires a tailored evaluation based on your specific requirements.

Unlocking Value in the Utilities Sector with XLU ETF

Investors seeking consistent income and diversification often turn to the utilities sector. The sector's fundamental nature provides resilience during market volatility. However, investing in this niche can be challenging without the right resources. Enter the XLU ETF, a comprehensive approach designed to enhance exposure to the utilities sector.

The XLU ETF follows the behavior of the S&P Utilities Select Industry Index, providing investors with a well-rounded portfolio of leading utilities companies. This participation allows investors to leverage the sector's growth while reducing risk through diversification.

The XLU click here ETF offers several benefits:

* Liquidity - Trading on major exchanges, XLU shares are easily bought and sold.

* Clarity - The ETF's holdings are publicly available, providing investors with a clear view of their investments.

* Low Costs - XLU maintains relatively low expense ratios, allowing for greater investment growth.

Understanding XLU's Future Potential: Factors to Consider

Navigating the future trajectory of any/various/diverse assets like XLU requires a thorough/meticulous/comprehensive analysis of several/numerous/multiple key factors. Investor sentiment/outlook/perspective toward the sector/industry/market in which XLU operates is paramount, as it can significantly influence demand/price/value. Furthermore, economic/global/political conditions and regulatory/governmental/legal changes can impact/affect/influence XLU's performance. It is also essential/crucial/critical to consider the company's/organization's/firm's own strategies/plans/initiatives for growth and innovation/development/advancement.

- Understanding the competitive/market/industry landscape is vital/essential/crucial for assessing XLU's potential/opportunity/ prospects

- Technological advancements and their influence/impact/effect on the sector/industry/market can shape/define/determine XLU's future trajectory/direction/course

- Risk assessment/management/mitigation is paramount/crucial/essential for investors considering/evaluating/analyzing XLU's long-term viability/potential/success

By carefully/thoroughly/meticulously evaluating these factors, investors can gain/acquire/develop a more informed/comprehensive/well-rounded understanding of XLU's future potential/prospects/opportunities.

In Volatile Markets? XLU ETF: A Prudent Choice

As investor grapple with the volatile nature of the modern market, seeking safe havens and steady growth has become paramount. The XLU ETF, tracking the performance of S&P 500 utilities companies, presents itself as a viable option for portfolio balancing. Traditionally, utility stocks have demonstrated durability during periods of uncertainty. Their critical infrastructure in society ensures a reliable income flow, providing investors with a comforting hedge. However, it's crucial to consider the ETF's holdings and economic outlook before making an informed decision.

Numerous factors, including regulatory changes, technological advancements, and environmental concerns, can impact the performance of the utilities sector. Therefore, a comprehensive analysis is essential for investors to determine if XLU ETF aligns with their investment goals.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Neve Campbell Then & Now!

Neve Campbell Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Yasmine Bleeth Then & Now!

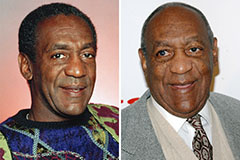

Yasmine Bleeth Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!